Does It Make Sense To Buy a Home Right Now?

Thinking about buying a home? If so, you're probably wondering: should I buy now or wait? Nobody can make that decision for you, but here's some information that can help you decide.

What’s Next for Home Prices?

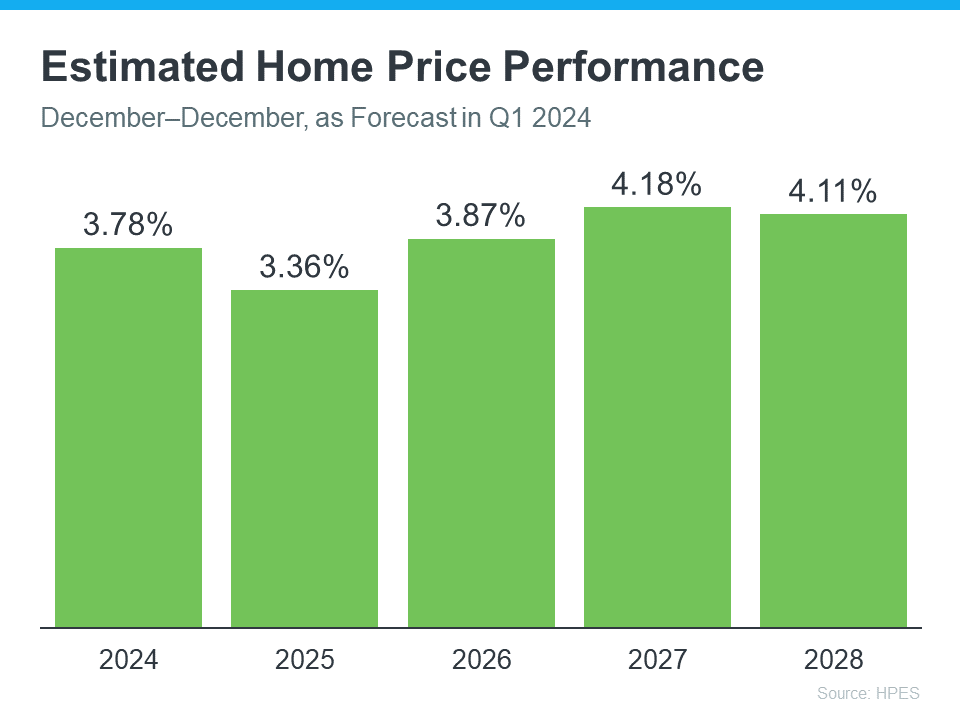

Each quarter, Fannie Mae and Pulsenomics publish the results of the Home Price Expectations Survey (HPES). It asks more than 100 experts—economists, real estate professionals, and investment and market strategists—what they think will happen with home prices.

In the latest survey, those experts say home prices are going to keep going up for the next five years (see graph below):

Here’s what all the green on this chart should tell you. They’re not expecting any price declines. Instead, they’re saying we’ll see a 3-4% rise each year.

And even though home prices aren’t expected to climb by as much in 2025 as they are 2024, keep in mind these increases can really add up over time. It works like this. If these experts are right and your home's value goes up by 3.78% this year, it's set to grow another 3.36% next year. And another 3.87% the year after that.

What Does This Mean for You?

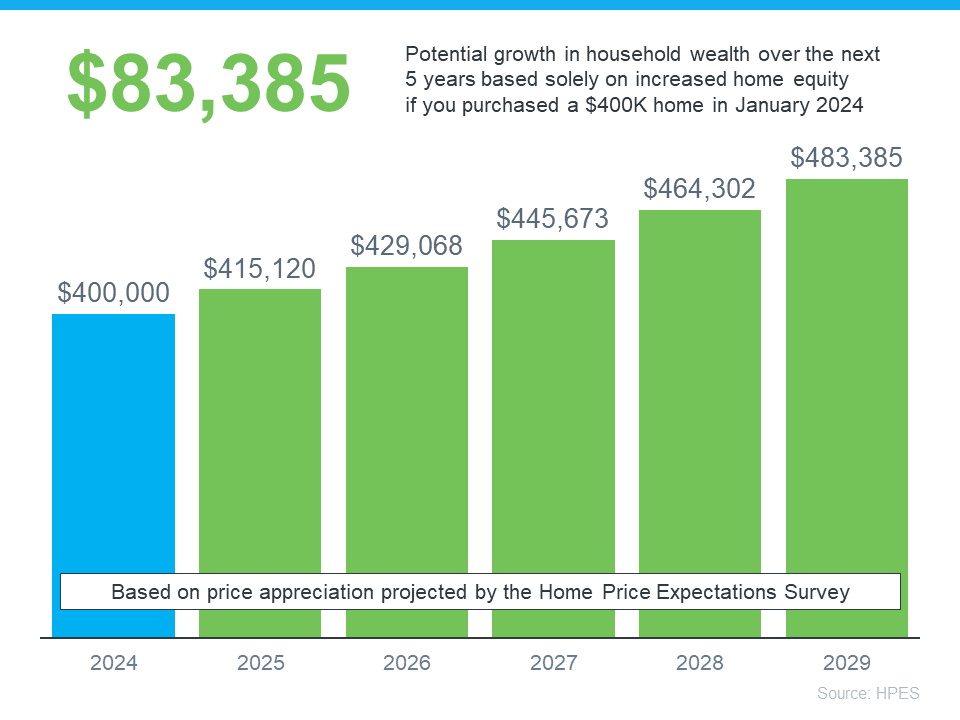

Knowing that prices are forecasted to keep going up should make you feel good about buying a home. That’s because it means your home is an asset that’s projected to grow in value in the years ahead.

If you’re not convinced yet, maybe these numbers will get your attention. They show how a typical home’s value could change over the next few years using expert projections from the HPES. Check out the graph below:

In this example, imagine you bought a home for $400,000 at the start of this year. Based on these projections, you could end up gaining over $83,000 in household wealth over the next five years as your home grows in value.

Of course, you could also wait – but if you do, buying a home is just going to end up costing you more.

Bottom Line

If you're thinking it's time to get your own place, and you’re ready and able to do so, buying now might make sense. Your home is expected to keep getting more valuable as prices go up. Let’s team up to start looking for your next home today.

532 Jade St

FOR SALE →532 Jade St., Petaluma $825,000 3 Bedrooms 2.5 Bathrooms 1,907 sq. ft. Year Built 2017 $825,000 Welcome to 532 Jade Street in the highly sought-after Quarry Heights! Nestled in the heart of West Petaluma and constructed in 2017, this remarkable split-level end unit home boasts three bedrooms, two and a half baths, and […]

Read MoreIs Your House Priced Too High?

🏠 Every seller wants to get their house sold quickly, for as much money as they can, with as few headaches as possible. And chances are…. Read more….

Read More

Timo Rivetti has been serving his clients with a highly individualized service tailored to specific needs and requirements since 1998. Unparalleled knowledge and expertise in the region is invaluable when it comes to buying and selling real estate. Hiring an agent who knows the area inside out makes all the difference in a competitive market. Timo and his team of experienced professionals work with each and every client to find and secure the perfect property at the best price, with all of the required amenities in the right neighborhood. When it’s time to make a move, call Timo.

What My Clients Have To Say

WHY NAVIGATE REAL ESTATE

If you live here already, you know how blessed we are. If you're considering living or investing here, you've probably experienced some of the area's extraordinary possibilities: country settings and small-town communities; enthralling agricultural beauty, and true farm to fork lifestyle, If Northern California is your real estate destination, you've arrived at the right spot. Whether you're looking to buy your first home - or to sell an estate - expect nothing less from us than a Meritage blend of real estate expertise, professional service, creativity, and a passion for achieving your goals.

NAVIGATE REAL ESTATE PETALUMA LAUNCH PARTY A BIG SUCCESS!

Never mind the rain, more than 200 people turned out on a gloomy, wet Thursday afternoon and into the evening

for the official ribbon cutting and launch party of our newly revamped office space in Theatre Square.

The Navigate RE Team, along with agents from all over the North Bay and beyond gathered with Timo and Renee’s client family and friends including those of 13 newly signed agents in the updated Petaluma office for a fabulous launch party on Leap Year’s Day, February 29th.

“It was a fantastic gathering,” says Timo. “Thanks to the Navigate RE Team for a full-service bar, Sahar from La Dolce Vita Wine Bar for a steady flow of delicious appetizers and D.J Tanner Wyre with Paradise Found Records & Music in downtown Petaluma for spinning the discs, live.” (Visit La Dolce Vita at ldvwine.com and ParadiseFoundRecordsMusic.com for more information).

Petaluma Chamber of Commerce ribbon cutting attracted a large crowd, despite the rain. “It was so much fun and so warm and inviting inside that no one wanted to leave,” says Timo. If you missed it, there will be more frequent gatherings. “It’s a very inclusive spot,” says Timo. “I’m loving my new-look private office, come by and say hello if you see me in there!”

The office is located downtown at 140 Second Street #108 ... learn more about NavigateRE click here.

Timo Rivetti has been serving his clients with a highly individualized service tailored to specific needs and requirements since 1998. Unparalleled knowledge and expertise in the region is invaluable when it comes to buying and selling real estate. Hiring an agent who knows the area inside out makes all the difference in a competitive market. Timo and his team of experienced professionals work with each and every client to find and secure the perfect property at the best price, with all of the required amenities in the right neighborhood. When it’s time to make a move, call Timo.

What My Clients Have To Say

WHY NAVIGATE REAL ESTATE

If you live here already, you know how blessed we are. If you're considering living or investing here, you've probably experienced some of the area's extraordinary possibilities: country settings and small-town communities; enthralling agricultural beauty, and true farm to fork lifestyle, If Northern California is your real estate destination, you've arrived at the right spot. Whether you're looking to buy your first home - or to sell an estate - expect nothing less from us than a Meritage blend of real estate expertise, professional service, creativity, and a passion for achieving your goals.

ARTS ALIVE WITH ARTIST MARY FASSBINDER THURSDAY MARCH 21ST 5-8PM

Join us at our office on Thursday evening, March 21st for our first Arts Alive event, featuring Petaluma artist and ceramicist Mary Fassbinder. Refreshments served. Arts Alive connects and promotes Petaluma’s vibrant arts community every third Thursday at multiple events around town. Check out the schedule and locations for Arts Alive by clicking here.

“I’m delighted to feature local artists for my private office, art which can be viewed from Second Street,” says Timo. Currently featured are works by Gail Foulkes, Mary Fassbinder and Roberta Ahrens. “I’ve been collecting works by local artists for my home for a while,” says Timo. “It’s good to extend the practice to my office, downtown. Arts Alive is the perfect program to spotlight and showcase favorite artists in the area.”

Timo Rivetti has been serving his clients with a highly individualized service tailored to specific needs and requirements since 1998. Unparalleled knowledge and expertise in the region is invaluable when it comes to buying and selling real estate. Hiring an agent who knows the area inside out makes all the difference in a competitive market. Timo and his team of experienced professionals work with each and every client to find and secure the perfect property at the best price, with all of the required amenities in the right neighborhood. When it’s time to make a move, call Timo.

What My Clients Have To Say

WHY NAVIGATE REAL ESTATE

If you live here already, you know how blessed we are. If you're considering living or investing here, you've probably experienced some of the area's extraordinary possibilities: country settings and small-town communities; enthralling agricultural beauty, and true farm to fork lifestyle, If Northern California is your real estate destination, you've arrived at the right spot. Whether you're looking to buy your first home - or to sell an estate - expect nothing less from us than a Meritage blend of real estate expertise, professional service, creativity, and a passion for achieving your goals.

Timo Testimonial 5-Star Review

My wife and I had heard really positive things about Timo. We switched strategies with realtors and hired Timo after testimonials from his previous clients, all of whom praised his character, loyalty, and professionalism. We were immediately impressed with his authentic demeanor, as he came across with great enthusiasm and a sincere understanding of our journey.

He had the house on the market within three weeks. We didn’t have to stage it or move out, because he convinced us that these were unnecessary expenses and that the quality and location of our home was enough to stand on its own. He took into consideration our financial concerns, which we deeply appreciated. Here’s the magic: Timo had one open house and sold it to the first buyers who looked at it! Not only did he sell our house, but the people who were interested had a house in the exact area that we had been waiting a year to find. He immediately saw the potential for BOTH parties and was able to create a deal where the buyers would buy our house, and we could buy theirs! It was a storybook scenario for both parties, and Timo navigated us through all the uncharted territories of such an unusual real estate occurrence.

Timo is an outstanding real estate agent, and an extraordinary human being, with vital connections all over Sonoma County. He is at the pulse of everything that’s happening in real estate, and whether you are buying or selling, he will make sure that you reach your goals. Thank you Timo, for helping all of us start a new chapter in our lives. - Cambridge Seller

Timo Rivetti has been serving his clients with a highly individualized service tailored to specific needs and requirements since 1998. Unparalleled knowledge and expertise in the region is invaluable when it comes to buying and selling real estate. Hiring an agent who knows the area inside out makes all the difference in a competitive market. Timo and his team of experienced professionals work with each and every client to find and secure the perfect property at the best price, with all of the required amenities in the right neighborhood. When it’s time to make a move, call Timo.

What My Clients Have To Say

WHY NAVIGATE REAL ESTATE

If you live here already, you know how blessed we are. If you're considering living or investing here, you've probably experienced some of the area's extraordinary possibilities: country settings and small-town communities; enthralling agricultural beauty, and true farm to fork lifestyle, If Northern California is your real estate destination, you've arrived at the right spot. Whether you're looking to buy your first home - or to sell an estate - expect nothing less from us than a Meritage blend of real estate expertise, professional service, creativity, and a passion for achieving your goals.

MORE HOUSES ON THE MARKET IN PETALUMA THIS SPRING

The California housing market has shown its resilience this year, rebounding in January after a six month slump in the second half of 2023 when mortgage rates were at a high. According to real estate watch dogs, interest rates are expected to decline later this year, improving inventory throughout 2024.

California Association of Realtors has expressed optimism that the overall outlook for the housing market appears positive as pent-up demand translates into sales. There is an increase in active new listings in the Petaluma area. “While mortgage rate fluctuations may influence potential new buyers and sellers,” says Timo “the prospect of a softening in the economy and a downward trend in interest rates in the coming months is helping with increased inventory locally.” This should provide buyers with more financial flexibility. However, there is still likely to be a tight inventory in the Petaluma area as housing demand continues to exceed supply availability.

Forecasts predict a substantial 22.9 percent increase in existing, single-family home sales this year, compared to last year. “Homes are moving swiftly,” says Timo. “The current average home value in Petaluma is around $900,000 with homes on the West Side averaging around $1.1m.” Real estate remains more expensive in Bodega Bay, Healdsburg, Penngrove, Sebastopol and Sonoma, which makes Petaluma all the more appealing, price wise, for a desirable Sonoma County address.

“There’s been a downward trend in many Bay Area cities and counties,” says Timo, “Sonoma County on the other hand, retains its value for the money in real estate investments whether you are looking to buy a home for yourself or to rent out.”

Planning helps everyone be a step ahead in addition to having an agent that is highly aware of the local market. Timo is always available to discuss your goals, talk strategy, pivot as needed and work for you in this fast-changing market. Call him today at 707. 477. 8396

Timo Rivetti has been serving his clients with a highly individualized service tailored to specific needs and requirements since 1998. Unparalleled knowledge and expertise in the region is invaluable when it comes to buying and selling real estate. Hiring an agent who knows the area inside out makes all the difference in a competitive market. Timo and his team of experienced professionals work with each and every client to find and secure the perfect property at the best price, with all of the required amenities in the right neighborhood. When it’s time to make a move, call Timo.

What My Clients Have To Say

WHY NAVIGATE REAL ESTATE

If you live here already, you know how blessed we are. If you're considering living or investing here, you've probably experienced some of the area's extraordinary possibilities: country settings and small-town communities; enthralling agricultural beauty, and true farm to fork lifestyle, If Northern California is your real estate destination, you've arrived at the right spot. Whether you're looking to buy your first home - or to sell an estate - expect nothing less from us than a Meritage blend of real estate expertise, professional service, creativity, and a passion for achieving your goals.

MEYER LEMON GINGER SCONES

- 2 1/4 cups plain flour

- 1/4 cup sugar

- 1 tablespoon baking powder

- 2 teaspoons finely grated Meyer lemon zest

- 1/2 teaspoon salt

- 1 1/2 cups heavy cream

- 1/4 cup plus

- 2 teaspoons fresh Meyer lemon juice

- 1/4 cup finely chopped candied ginger

- 2 cups powdered sugar

Preheat the oven to 375°. Line a baking sheet with parchment paper. Whisk flour with sugar, baking powder, lemon zest & salt. Stir in cream and a couple of tablespoons of lemon juice & fold in the candied ginger. Gently knead the dough on a lightly floured work surface until it all comes together. Form a 9-inch round, around 1/2 inch thick. Slice dough into8 wedges and arrange an inch apart on the baking sheet. Bake for 20 to 25minutes, until slightly firm and lightly browned on the bottom, pale on top. Cool for five minutes or so, before transferring to a rack to cool completely. Whisk powdered sugar with the remaining lemon juice until the glaze is smooth. Drizzle lemon glaze over the scones and let stand before serving.

Timo Rivetti has been serving his clients with a highly individualized service tailored to specific needs and requirements since 1998. Unparalleled knowledge and expertise in the region is invaluable when it comes to buying and selling real estate. Hiring an agent who knows the area inside out makes all the difference in a competitive market. Timo and his team of experienced professionals work with each and every client to find and secure the perfect property at the best price, with all of the required amenities in the right neighborhood. When it’s time to make a move, call Timo.

What My Clients Have To Say

WHY NAVIGATE REAL ESTATE

If you live here already, you know how blessed we are. If you're considering living or investing here, you've probably experienced some of the area's extraordinary possibilities: country settings and small-town communities; enthralling agricultural beauty, and true farm to fork lifestyle, If Northern California is your real estate destination, you've arrived at the right spot. Whether you're looking to buy your first home - or to sell an estate - expect nothing less from us than a Meritage blend of real estate expertise, professional service, creativity, and a passion for achieving your goals.

IT’S A PARTY! JOIN US FOR A GRAND OPENING SOCIAL IN THEATRE SQUARE, THURSDAY FEBRUARY 29TH 4-7PM

Celebrate Leap Year’s bonus day, Thursday, February 29th with Timo, Frances, Renee and the NavigateRE Petaluma Real Estate Team in a festive gathering to officially re-open the doors of our beautifully revamped office in Petaluma’s Theatre Square.

You are invited and we’d love to see you! Mark your calendar and come on down to Second Street for

complimentary bites and bubbles between 4pm and 7pm. We look forward to toasting this wonderful new

partnership, welcoming new agents and catching up with our friends and client-family.

February started off with a batting down of the hatches, here in Sonoma Country, so if it’s beginning to feel like one of the longest months of winter by now, then that’s all the more reason to wrap up, head out and join us for this fun, casual gathering on the 29th.

We love to reconnect and it’s been a while since we’ve partied at the office! NavigateRE at 140 Second Street #108 Questions? Call Timo 707- 477- 8396.

Timo Rivetti has been serving his clients with a highly individualized service tailored to specific needs and requirements since 1998. Unparalleled knowledge and expertise in the region is invaluable when it comes to buying and selling real estate. Hiring an agent who knows the area inside out makes all the difference in a competitive market. Timo and his team of experienced professionals work with each and every client to find and secure the perfect property at the best price, with all of the required amenities in the right neighborhood. When it’s time to make a move, call Timo.

What My Clients Have To Say

WHY NAVIGATE REAL ESTATE

If you live here already, you know how blessed we are. If you're considering living or investing here, you've probably experienced some of the area's extraordinary possibilities: country settings and small-town communities; enthralling agricultural beauty, and true farm to fork lifestyle, If Northern California is your real estate destination, you've arrived at the right spot. Whether you're looking to buy your first home - or to sell an estate - expect nothing less from us than a Meritage blend of real estate expertise, professional service, creativity, and a passion for achieving your goals.

FEBRUARY’S FAST-UPTICK IN SONOMA COUNTY REAL ESTATE ACTIVITY

Last year was a challenging year in real estate given the shortage of homes on the market, locally, compounded by high borrowing costs, but the good news is that 2024 has started off with a significant recharge in activity here in the Petaluma area.

“A significant bounce back in market interest and new year sales has my phone ringing at a level I haven’t seen in many months,” says Timo. “It’s extremely encouraging for buyers and sellers.”

“I’m optimistic that this positive turn in the housing market marks a new chapter, though tight housing supply is something that we will continue to deal with here in the south county. Petaluma’s growth boundary protects the sprawl that shapes other communities, which makes this all the more desirable as a place to live.” According to industry specialists, California’s state housing market

is expected to rebound due, largely to a cooling inflation of mortgage rates. Forecasts call for an increase of 22.0 percent in existing, single-family home sales compared to last year.

Looking for a deal in the Bay Area and surrounding region this year? According to date, cities which may see home price declines up to -7.8% by the end of the year include Santa Rosa, Ukiah, San Francisco, Clearlake and Napa. “Whatever housing-related move you make this year, it’s more important than ever to consult with an experienced real estate professional to gain deeper insight into the market dynamics,” says Timo. “Petaluma and surrounding areas in Sonoma County remain a complex market with an imbalance between supply and demand. Although this continues to drive pricing, the area is still known for

competitive pricing when compared to most all of the other Bay Area counties.”

Managing pricing expectations is key. “My sellers work with me to grasp the accurate value of their properties, as opposed to over-inflating and having a home sit on the market,” says Timo. “Likewise, it is vital for buyers to be fully prepared, know what they can afford and be flexible

in a multiple-offer scenario.” Well priced homes in great condition generally sell fast. “If you’re thinking of selling your home this year, let’s talk about what you can do now to prepare your property for the market,” Timo says. “In a world where technology is fast and faceless, the value

of transparency, explanation, empathy and patience during a real estate transaction remains a core element of the Rivetti Team’s service.

Communication is key. And Timo loves to listen, talk strategy, pivot and negotiate in a fast-changing market. Call him today at 707 - 477 - 8396.

Timo Rivetti has been serving his clients with a highly individualized service tailored to specific needs and requirements since 1998. Unparalleled knowledge and expertise in the region is invaluable when it comes to buying and selling real estate. Hiring an agent who knows the area inside out makes all the difference in a competitive market. Timo and his team of experienced professionals work with each and every client to find and secure the perfect property at the best price, with all of the required amenities in the right neighborhood. When it’s time to make a move, call Timo.

What My Clients Have To Say

WHY NAVIGATE REAL ESTATE

If you live here already, you know how blessed we are. If you're considering living or investing here, you've probably experienced some of the area's extraordinary possibilities: country settings and small-town communities; enthralling agricultural beauty, and true farm to fork lifestyle, If Northern California is your real estate destination, you've arrived at the right spot. Whether you're looking to buy your first home - or to sell an estate - expect nothing less from us than a Meritage blend of real estate expertise, professional service, creativity, and a passion for achieving your goals.

HOME TRENDS FOR FEBRUARY

As we reported last month, cool grays and stark whites are on their way out of favor with designers incorporating warm, earthy neutrals to create a calm and welcoming environment in the kitchen and throughout the home.

Beige is back, as is creamy off-white, soft green and rich brown. So, keep that in mind during your remodeling. Different tones, textures and patterns creating a layered look are in, adding depth to home décor.

Bold, dramatic moves are also becoming more popular, with more use of graphic stone, floral wallpaper, large artwork, oversized light fittings and furniture. Sustainable choice renovations remain popular, as modern interiors embrace older elements such as handmade clay tile, brick and rustic wood. Clutter is out. Appliance garages are in. What’s an appliance garage? It’s a sliding cabinet or other specialized cabinetry designed to tuck away appliances and hide gadgets and chargers.

Regardless of your new design choices, updating can not only increase value in your home, but create a welcoming environment for friends and family to enjoy for years. Start one room at a time, evaluate potential changes, plan needs vs wants and budget your remodel. Whether a big remodel or small changes of paint, rugs, pillows, and linens it can make a house ... into a home!

Timo Rivetti has been serving his clients with a highly individualized service tailored to specific needs and requirements since 1998. Unparalleled knowledge and expertise in the region is invaluable when it comes to buying and selling real estate. Hiring an agent who knows the area inside out makes all the difference in a competitive market. Timo and his team of experienced professionals work with each and every client to find and secure the perfect property at the best price, with all of the required amenities in the right neighborhood. When it’s time to make a move, call Timo.

What My Clients Have To Say

WHY NAVIGATE REAL ESTATE

If you live here already, you know how blessed we are. If you're considering living or investing here, you've probably experienced some of the area's extraordinary possibilities: country settings and small-town communities; enthralling agricultural beauty, and true farm to fork lifestyle, If Northern California is your real estate destination, you've arrived at the right spot. Whether you're looking to buy your first home - or to sell an estate - expect nothing less from us than a Meritage blend of real estate expertise, professional service, creativity, and a passion for achieving your goals.

LOW COUNTRY BROIL FOR 8 TO 10

- ½ cup concentrated seafood broil seasoning

- 4 pounds of medium red potatoes, sliced in half or quarters

- 2 large, sweet onions, peeled and quartered

- 2 ½ pounds cured, smoked sausage links, sliced into two-inch pieces

- 8 ears of fresh corn, halved

- 4 pounds medium shrimp

Half fill a large stockpot with water. Add seasoning and bring to a boil. Add potatoes, return to a boil for five minutes. Add sausage and onions and boil on medium heat for 15 minutes. Add corn, bring water back to a boil and cook another 10 minutes or so. Add shrimp, bring back to a boil once more and cook until the shrimp turn pink, around three minutes. Drain through a colander

and serve on a large platter.