FOR SALE

→ 618-620 E St

$799,000

Petaluma

618-620 E St

Duplex | 2 Bed | 2 Bath | 1,527 sq. ft.

Offered for: $799,000

-

MLS Number: 326006846

-

Bedrooms: 2

-

Bathrooms: 2 (Full)

-

Square Footage: 1,527 sqft

-

Lot Size: 7,501 sqft

-

Year Built: 1880

-

Single family with duplex units

-

Massive lot for ADU expansion

-

Charming vintage Victorian character

-

Two-car carport plus extra spaces

-

Classic pillar and post construction

-

Efficient floor furnace and gas

-

Timeless wood siding aesthetic

-

Durable composition shingle roof

-

Charming covered front porch

-

Convenient single-story floor plan

-

Laminate and carpet flooring mix

-

Dedicated laundry hookups on-site

-

Free-standing gas ranges included

-

Connected to public city services

-

Iconic E Street downtown corridor

-

SB19 potential for increased density

-

Live in one, rent another

-

Massive sweat-equity investment opportunity

Every Home Has a Story...

Explore this home's story.

At Navigate Real Estate, we believe every home deserves to have its story told. To the right, you'll find an interactive digital booklet that brings this property to life. Take the tour and explore every detail-from standout features and modern comforts to the neighborhood amenities that make this area such a great place to call home. Click now to watch the story and see if this could be your next chapter.

Click the image to the right and read this home's story.

FOR SALE

→ 534 Jade St

$729,000

Petaluma

534 Jade Street

2 Bedrooms | 3 Baths | 1,907 sq. ft.

Offered for: $729,000

-

MLS# 321024419

-

2+ bedrooms

-

2.5 bathrooms

-

1,907± square feet

-

Built in 2017

-

Premium end-unit lot

-

Three-level floorplan

-

Primary suite on entry level

-

Walk-in primary closet

-

Dual-sink primary vanity

-

Separate soaking tub & shower

-

Open-concept living level

-

South & West-facing views

-

Balcony off living room

-

Engineered birch wood floors

-

Granite kitchen countertops

-

Kitchen island with power

-

Walk-in pantry

-

5’ x 11’ den/office

-

Three-zone HVAC system

-

Home network wiring

-

Energy Star certified

-

GreenPoint rated home

-

Landscaped backyard with pavers

Every Home Has a Story...

Explore this home's story.

At Navigate Real Estate, we believe every home deserves to have its story told. To the right, you'll find an interactive digital booklet that brings this property to life. Take the tour and explore every detail-from standout features and modern comforts to the neighborhood amenities that make this area such a great place to call home. Click now to watch the story and see if this could be your next chapter.

Click the image to the right and read this home's story.

FOR SALE

→ 146 Shelina Vista Ln

$TBD

Petaluma

146 Shelina Vista Ln

5 Bedrooms | 4 Baths | 3,606 sq. ft.

Offered for: $TBD

-

MLS# 325030184

-

Single-level estate

-

Nearly 3 private acres

-

3,606 sq ft home

-

Five bedrooms total

-

Three-and-a-half baths

-

Built in 2000

-

Cathedral ceilings

-

Hardwood flooring

-

Two fireplaces

-

Wall of view windows

-

Open-concept kitchen

-

Large center island

-

Expansive entertaining deck

-

Private guest suite entrance

-

Home office flexibility

-

Resort-style swimming pool

-

Pool house and gazebo

-

Open pasture land

-

Owned solar system

-

Whole-house generator

-

EV charging capability

-

Oversized 4+ car garage

- +/- 2.98 Acres

Every Home Has a Story...

Explore this home's story.

At Navigate Real Estate, we believe every home deserves to have its story told. To the right, you'll find an interactive digital booklet that brings this property to life. Take the tour and explore every detail-from standout features and modern comforts to the neighborhood amenities that make this area such a great place to call home. Click now to watch the story and see if this could be your next chapter.

Click the image to the right and read this home's story.

FOR SALE

→ 563 Jefferson Street

$1,550,000

Napa

563 Jefferson St

Large 2,700 sq. ft. Commercial Office Building

Offered for $1,550,000

-

MLS# 325102912

-

Live/work potential

-

OC zoning

-

Across from Fuller Park

-

Approx. 2,700 sq ft

-

Built in 1914

-

Two-story layout

-

Seven private offices

-

Large conference room

-

Reception area

-

Two restrooms

-

Cozy kitchen

-

Hardwood floors

-

Built-in cabinetry

-

Operable windows

-

Two decorative fireplaces

-

Classic Craftsman details

-

Five on-site parking spaces

-

Additional street parking

-

Excellent visibility

-

Walk to downtown Napa

-

Near dining and shops

-

Professional or creative use

-

Unique Napa opportunity

563 Jefferson St, Napa, CA 94559

3 Beds | 2 Baths | 2,700 Sq Ft | $1,550,000 | MLS# 325102912

A rare opportunity in the heart of Napa, this beautifully preserved Craftsman-style live/work property sits directly across from iconic Fuller Park, offering unmatched visibility, flexibility, and charm. Originally built in 1914 and thoughtfully converted for professional use, the property is zoned OC (Office Commercial) with potential for residential or mixed-use occupancy.

Spanning approximately 2,700 square feet, the two-story layout currently features seven private offices, a large conference room, welcoming reception area, cozy kitchen, and two restrooms. Rich architectural details remain intact, including hardwood floors, built-in cabinetry, operable windows, and two decorative fireplaces, creating a warm, elevated environment ideal for professional, creative, or boutique business use.

The property includes five on-site parking spaces, supplemented by convenient street parking. Located just blocks from Downtown Napa, world-class dining, tasting rooms, retail, and wine country attractions, this is a distinctive asset rarely available in such a premier setting. Buyer to verify zoning, permitted uses, and live/work eligibility.

NEIGHBORHOOD PROFILE – DOWNTOWN NAPA / FULLER PARK

Positioned across from Fuller Park, this location blends historic Napa character with vibrant urban energy. The park offers open green space, mature trees, and a central gathering point for the neighborhood. Surrounding streets are lined with charming period architecture, professional offices, boutique residences, and walkable amenities that define downtown Napa living and commerce.

LOCATION & ACCESS OVERVIEW

563 Jefferson Street offers exceptional accessibility while maintaining a refined, professional presence:

-

Fuller Park: Across the street

-

Downtown Napa: 5-minute walk

-

Napa Riverfront District: 7 minutes

-

Highway 29 Access: 3 minutes

-

Oxbow Public Market: 6 minutes

-

Napa Valley Vineyards: 10–15 minutes

Whether welcoming clients, hosting meetings, or enjoying the downtown lifestyle, this location keeps everything within easy reach.

CITY OVERVIEW – LIVING & WORKING IN NAPA, CA

Napa is internationally recognized for its wine country prestige, yet it remains deeply rooted in community, culture, and quality of life. Beyond vineyards and tasting rooms, the city offers art walks, culinary festivals, live music, farmers markets, and an ever-growing entrepreneurial scene.

Downtown Napa continues to thrive as a destination for professionals, creatives, and investors seeking a blend of lifestyle and opportunity. Walkability, historic preservation, and thoughtful development make Napa one of Northern California’s most desirable places to live, work, and invest.

Every Home Has a Story-Experience This One

At Navigate Real Estate, we believe every home deserves to have its story told. To the right, you'll find an interactive digital booklet that brings this property to life. Take the tour and explore every detail-from standout features and modern comforts to the neighborhood amenities that make this area such a great place to call home. Click now to watch the story and see if this could be your next chapter.

Click the image to the right and read this home's story.

WHO YOU WORK WITH MATTERS

Timo Rivetti has been serving his clients with a highly individualized service tailored to specific needs and requirements since 1998. Unparalleled knowledge and expertise in the region is invaluable when it comes to buying and selling real estate. Hiring an agent who knows the area inside out makes all the difference in a competitive market. Timo and his team of experienced professionals work with each and every client to find and secure the perfect property at the best price, with all of the required amenities in the right neighborhood. When it’s time to make a move, call Timo.

SOLD

→ 1713 Avila Ranch Dr.

$1,399,000

Petaluma

1713 Avila Ranch Drive

4 Bedrooms | 3 Baths | 2,541 sq. ft.

SOLD for: $1,399,000

RESULTS MATTER! See below for this home's story↴

With The Rivetti real Estate Team and Timo Rivetti, Partners with Navigate Real Estate, selling homes and land is more than a transaction - it's a curated process of strategy, storytelling, and innovative marketing. Every property is thoughtfully evaluated, and a tailored plan is designed to highlight its most unique features while ensuring maximum exposure to the right buyers.

This Property is a shining example. It showcases how our proven approach - from strategic positioning to compelling presentation - consistently delivers results that exceed expectations.

HOW WE DID IT

Every Home Has a Story...

Explore this home's story.

At Navigate Real Estate, we believe every home deserves to have its story told. To the right, you'll find an interactive digital booklet that brings this property to life. Take the tour and explore every detail-from standout features and modern comforts to the neighborhood amenities that make this area such a great place to call home. Click now to watch the story and see if this could be your next chapter.

Click the image to the right and read this home's story.

SOLD

→ 233 Jacquelyn Ln

$1,135,000

Petaluma

233 Jacquelyn Lane

3 Bedrooms | 3 Baths | 2,396 sq. ft.

SOLD for: $1,135,000

RESULTS MATTER! See below for this home's story↴

With Timo Rivetti, Broker Associate, Partner with Navigate Real Estate, selling homes and land is more than a transaction - it's a curated process of strategy, storytelling, and innovative marketing. Every property is thoughtfully evaluated, and a tailored plan is designed to highlight its most unique features while ensuring maximum exposure to the right buyers.

This Property is a shining example. It showcases how our proven approach - from strategic positioning to compelling presentation - consistently delivers results that exceed expectations.

HOW WE DID IT

SOLD

→ 63 Windsor Ln

$1,235,000

Petaluma

63 Windsor Lane

2 Bedrooms | 2 Baths | 2,041 sq. ft.

SOLD FOR: $1,235,000

RESULTS MATTER! See below for this home's story↴

With Erica & Petra Bergstrom, REALTORs® and Partners with Navigate Real Estate, selling homes and land is more than a transaction - it's a curated process of strategy, storytelling, and innovative marketing. Every property is thoughtfully evaluated, and a tailored plan is designed to highlight its most unique features while ensuring maximum exposure to the right buyers.

This Property is a shining example. It showcases how our proven approach - from strategic positioning to compelling presentation - consistently delivers results that exceed expectations.

HOW WE DID IT

Every Home Has a Story-Experience This One

At Navigate Real Estate, we believe every home deserves to have its story told. To the right, you'll find an interactive digital booklet that brings this property to life. Take the tour and explore every detail-from standout features and modern comforts to the neighborhood amenities that make this area such a great place to call home. Click now to watch the story and see if this could be your next chapter.

Click the image to the right and read this home's story.

SOLD

→ 65 Arlington Dr

$710,000

Petaluma

65 Arlington Drive

3 Bedrooms | 2 Baths | 1,562 sq. ft.

SOLD for: $710,000

RESULTS MATTER! See below for this home's story↴

With Erica & Petra Bergstrom, REALTORs® and Partners with Navigate Real Estate, selling homes and land is more than a transaction - it's a curated process of strategy, storytelling, and innovative marketing. Every property is thoughtfully evaluated, and a tailored plan is designed to highlight its most unique features while ensuring maximum exposure to the right buyers.

This Property is a shining example. It showcases how our proven approach - from strategic positioning to compelling presentation - consistently delivers results that exceed expectations.

HOW WE DID IT

Every Home Has a Story-Experience This One

At Navigate Real Estate, we believe every home deserves to have its story told. To the right, you'll find an interactive digital booklet that brings this property to life. Take the tour and explore every detail-from standout features and modern comforts to the neighborhood amenities that make this area such a great place to call home. Click now to watch the story and see if this could be your next chapter.

Click the image to the right and read this home's story.

FOR SALE

→ 837-839 Madison St

$888,000

Petaluma

837-839 Madison St

Two Units: 2 Beds | 1 Bath | 950 sq. ft. Each Unit

Offered for: $888,000

-

MLS #325074834

-

Duplex – 2 units

-

4 total bedrooms

-

2 total bathrooms

-

1,902 sq ft total

-

Built in 1978

-

Lot size: 0.26 acres

-

Updated interiors

-

New flooring throughout

-

Fresh interior paint

-

New fencing

-

In-unit laundry

-

Separate electric meters

-

Separate gas meters

-

Bright natural light

-

Detached carport

-

Ample parking spaces

-

Tile and vinyl flooring

-

Dishwasher included

-

Freestanding oven/range

-

Freestanding refrigerator

-

Microwave included

-

Heating: baseboard & wall furnace

-

Cooling: ceiling fans

Every Home Has a Story-Experience This One

At Navigate Real Estate, we believe every home deserves to have its story told. To the right, you'll find an interactive digital booklet that brings this property to life. Take the tour and explore every detail-from standout features and modern comforts to the neighborhood amenities that make this area such a great place to call home. Click now to watch the story and see if this could be your next chapter.

Click the image to the right and read this home's story.

Petaluma

2183 Live Oak Farm Lane

4 bedroom | 3.5 Baths | 2,997 sq. ft. +/-0 2.34 Acres

Pending for: $3,345,000

PENDING

→ 2183 Live Oak Farm

$3,450,000

4 Bedrooms

3.5 Baths

2,997 sq. ft.

+/- 2.34 Acre Lot

Farm Community

SUMMARY:

2183 Live Oak Farm Lane • Petaluma, CA

Custom-Built Modern Farmhouse in Sonoma County’s First Agrihood

Welcome to Live Oak Farm, where wine country charm meets modern sophistication in Sonoma County’s first agrihood community. Nestled on 2.34 acres in West Petaluma, this custom-built modern farmhouse offers a rare opportunity to own a brand-new home in a gated, farm-to-table neighborhood surrounded by rolling hills, orchards, and vineyard-dotted landscapes.

FEATURES:

-

Available Spring 2026

-

Single-level modern farmhouse

-

2.34-acre homesite

-

Located in Live Oak Farm

-

Sonoma County’s first agrihood

-

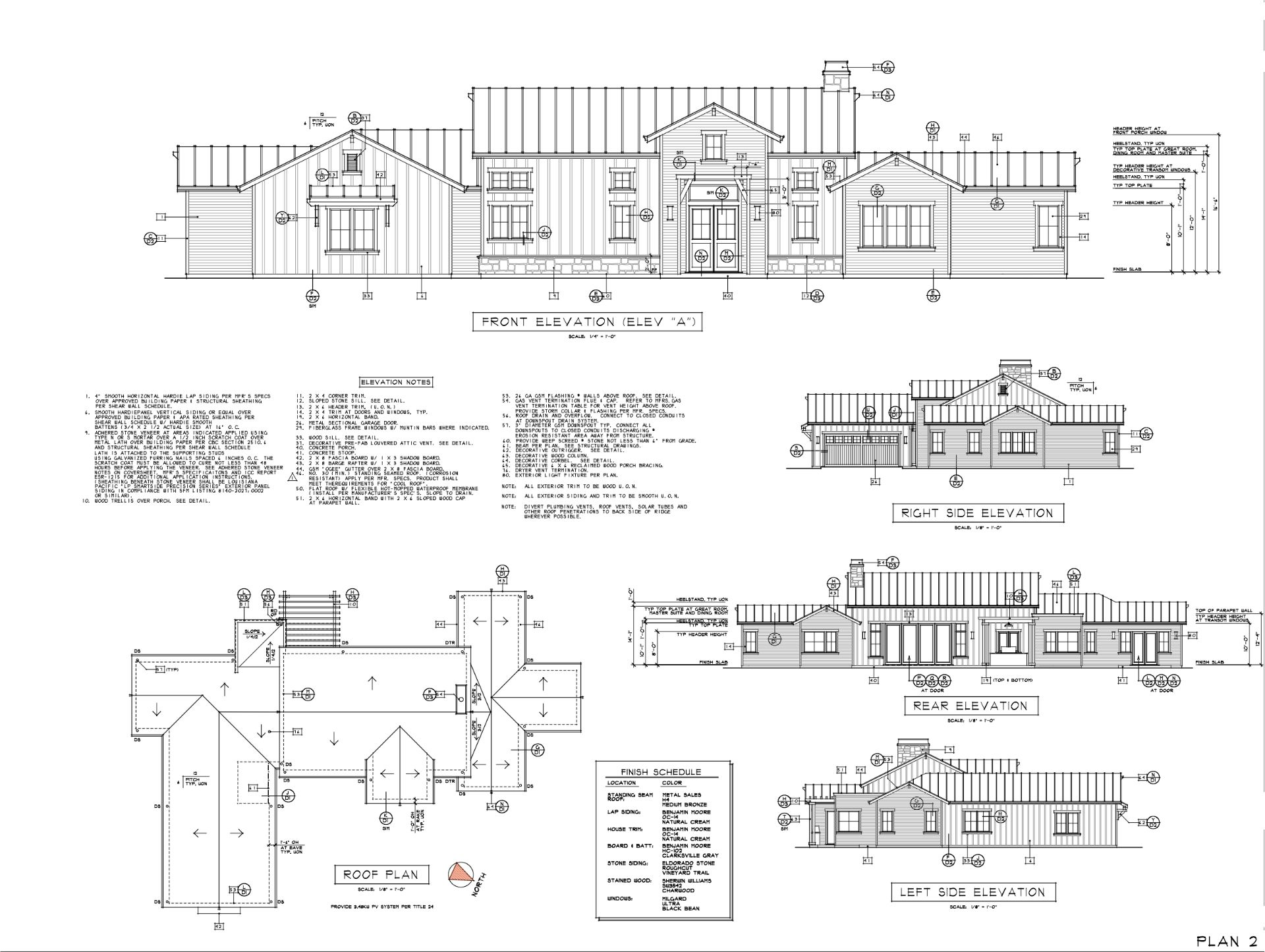

Designed by Farrell-Faber & Associates

-

Early buyer finish selections

-

Sweeping greenbelt views

-

Above Title 24 solar system

-

Battery backup included

-

Milgard windows and doors

-

LaCantina door at Great Room

-

7" white oak plank floors

-

Fisher & Paykel appliance package

-

48" electric range

-

Wine refrigerator included

-

Kitchen island prep sink

-

Farmhouse sink at counter

-

In-ceiling speakers throughout

-

Subwoofer integrated in cabinetry

-

Outdoor kitchen with speakers

-

Spa-inspired primary bathroom

-

66" freestanding soaking tub

-

ADU or pool potential

HIGHLIGHTS:

Homes like this are exceedingly rare on the west side of Petaluma, where new construction is limited. Options you get to choose:↴

HIGHLIGHTS:

Homes like this are exceedingly rare on the west side of Petaluma, where new construction is limited. Options you get to choose:↴

-

Interior paint color choices

-

Metal roof color options 8/31

-

Exterior siding color options

-

Input/augment AV scope before 10/1

-

$60k cabinet allowance 9/19

-

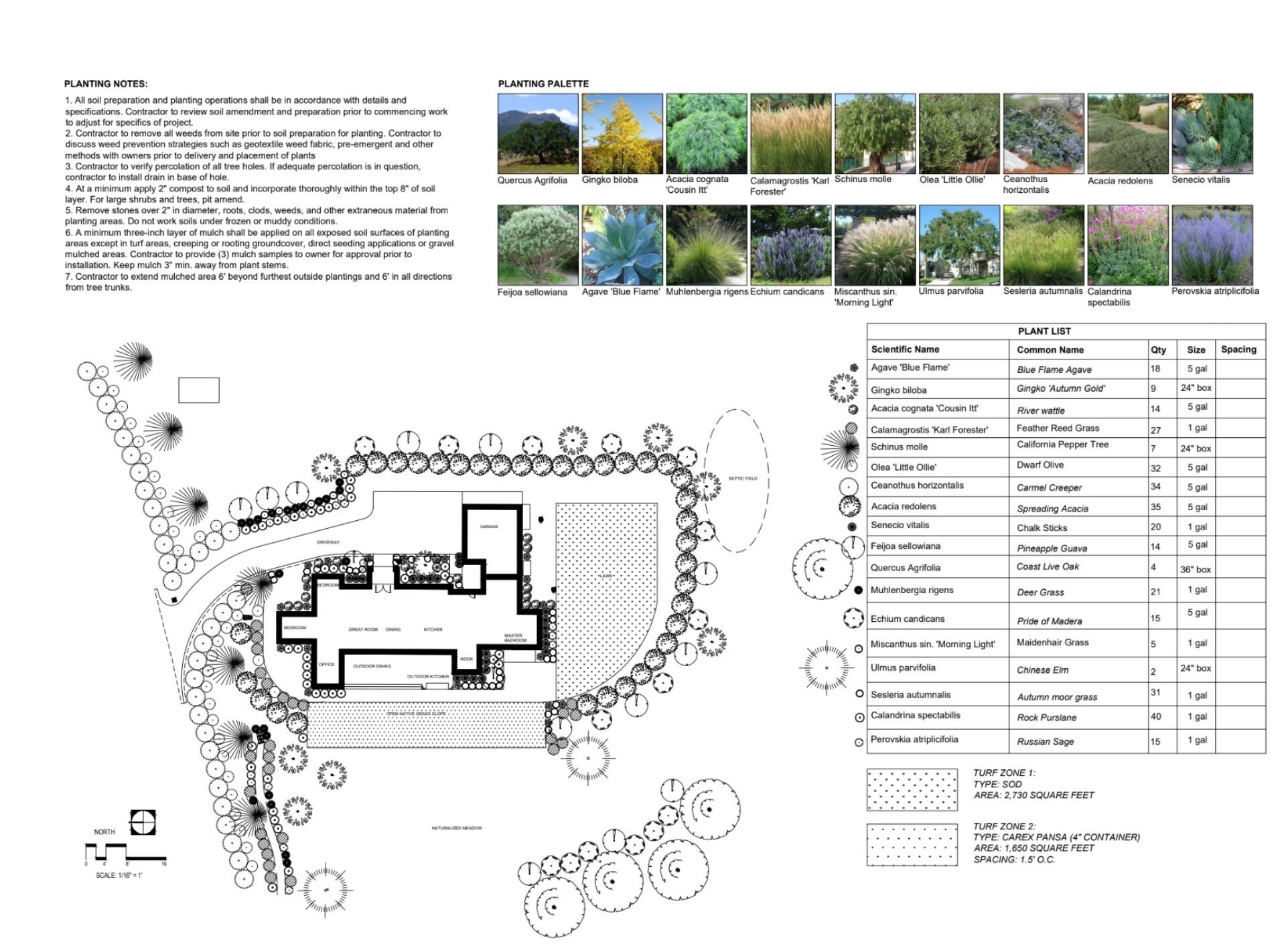

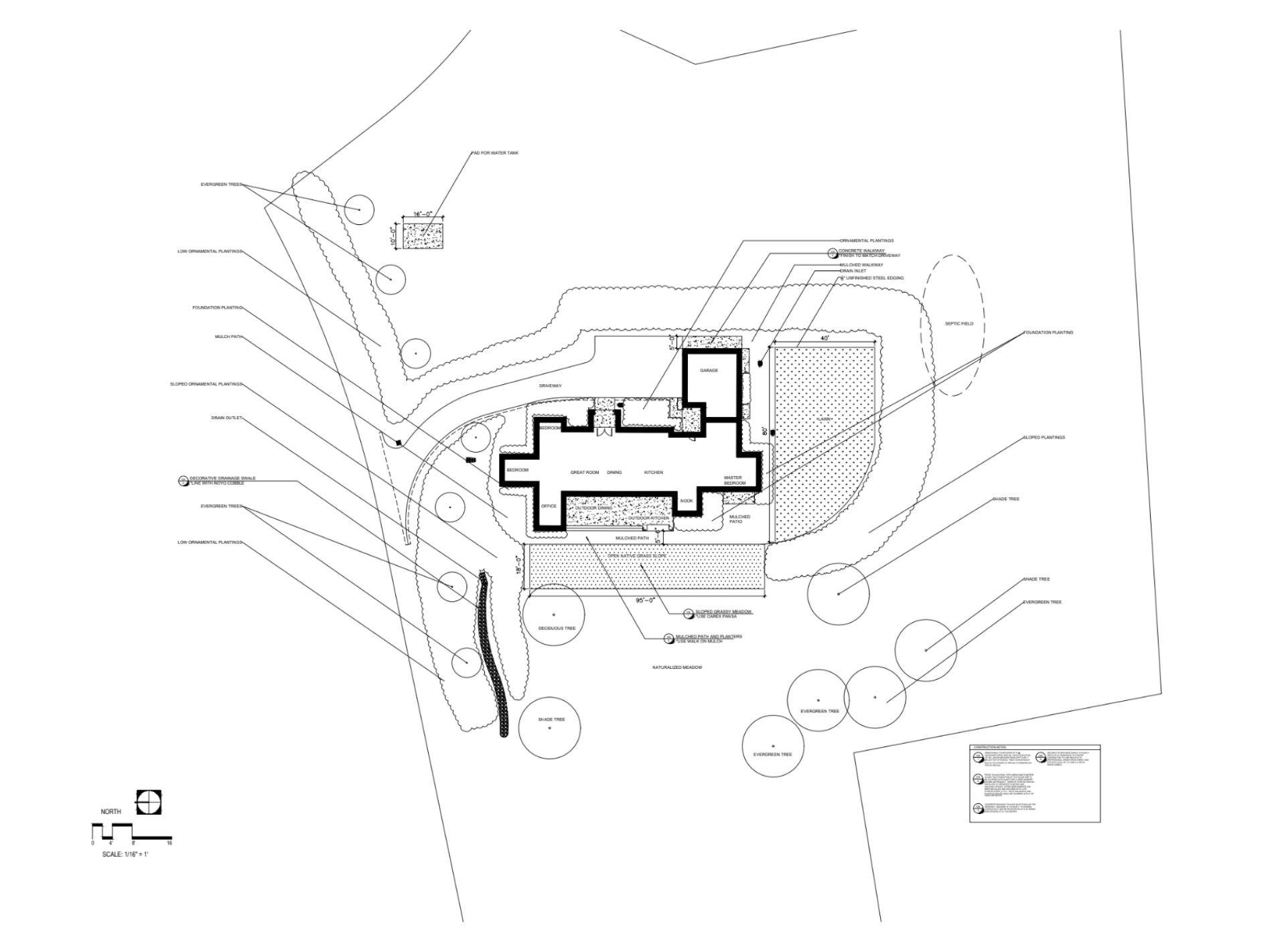

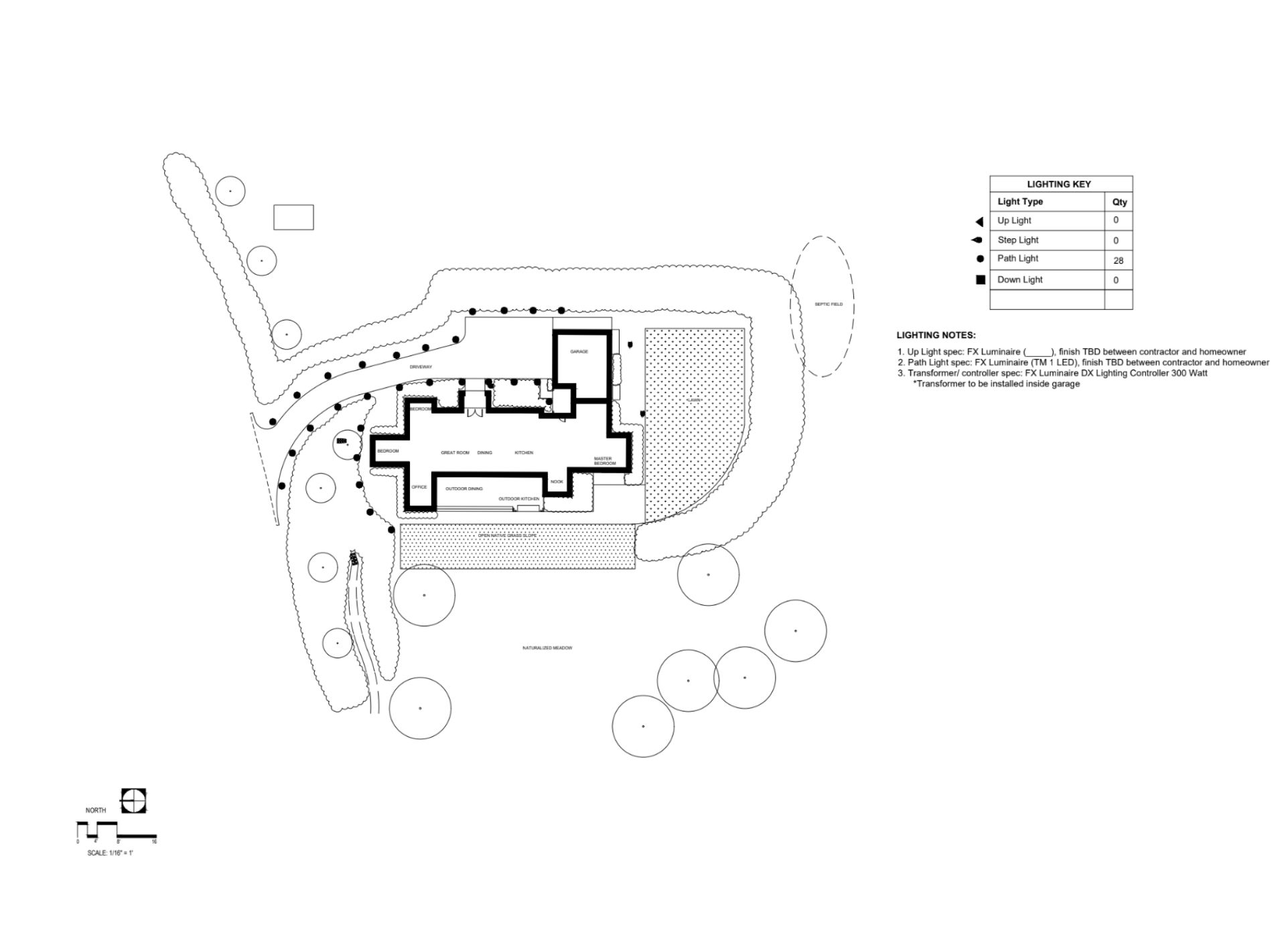

$50k landscape allowance

-

Modern Brass Kohler plumbing fixture finishes

- Hardware selection input

-

Kohler bath accessories, $5k

-

Slab stone, $2,400 per slab allowance

-

Tile allowance, $10 per sf

Finished Rendering↴

COMMUNITY

Live Oak Farm homeowners have access to a large community gathering space centered near the iconic century old white barn, juxtaposed to a newly built modern pavilion made of wood, glass and steel, with sliding barn doors that connect us to the land, creating a unique indoor/outdoor flow.

Residents are able to reserve the space for celebrations with family and friends - or just hang out together.

The space is an integral part of the agrihood’s mission to create connection with the surrounding community, a gathering space for people to come in, tell stories, and share experiences.

This space is also available to the broader community for select rental opportunities, such as weddings, business off-sites, parties, etc. For those interested, please contact info@liveoakfarm.com

We are currently building out these spaces with additional amenities and activities.

And just beyond the gate… Petaluma awaits.

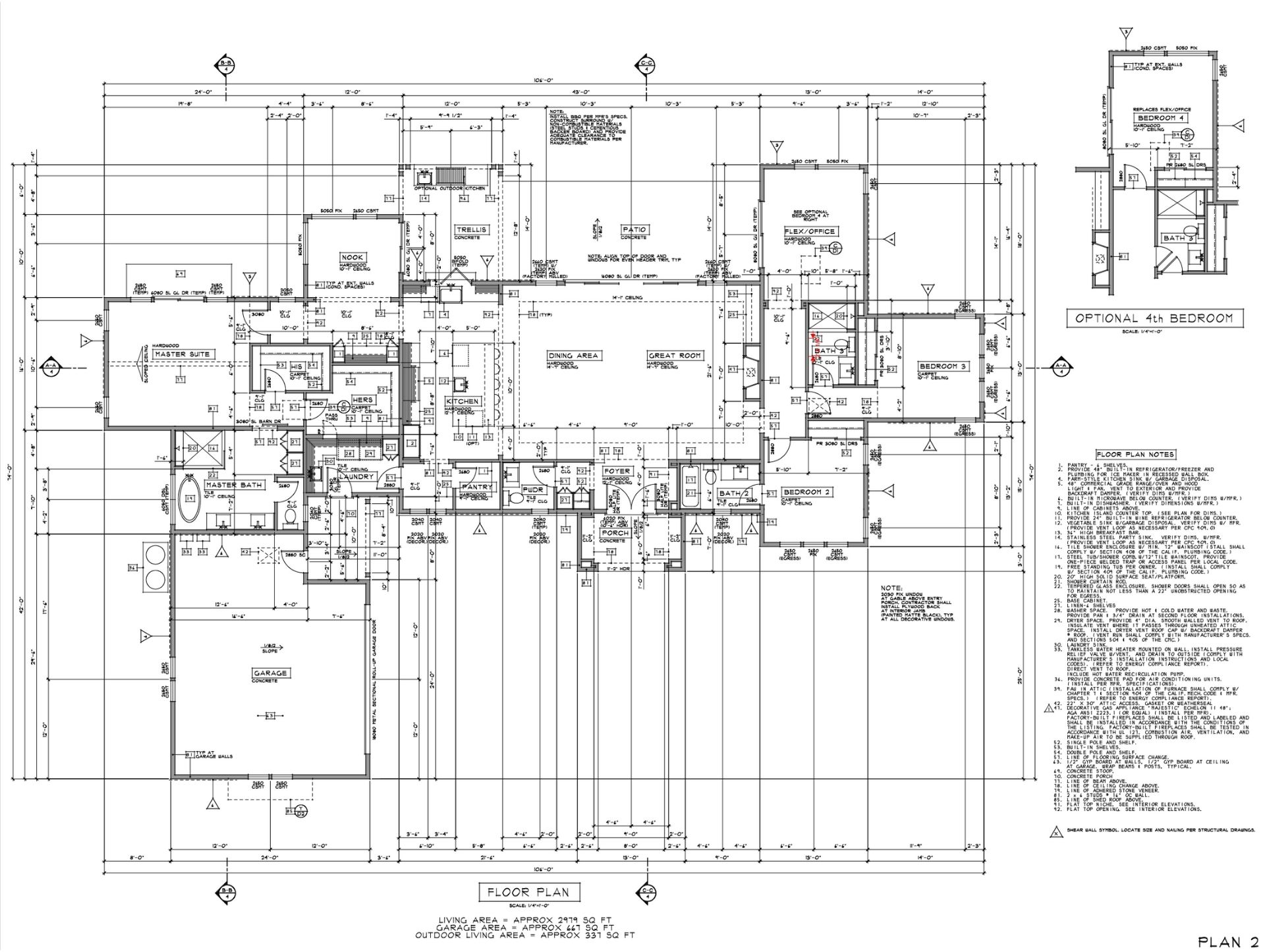

ELEVATION PLANS

FLOOR PLAN

FINAL LANDSCAPE DESIGN AND CONSTRUCTION TO BE WITHIN HOA GUIDELINES

PETALUMA

The dream of country living, with all of the modern comforts of the City and suburbs.

Less than 40 miles from the Golden Gate Bridge, not a single traffic light to the beach, and just minutes to historic downtown Petaluma lies Live Oak Farm, Sonoma County’s first agrihood – where agriculture meets neighborhood. This bucolic 30-acre, fourteen home community offers a quiet, simple, healthy lifestyle centered around an organic working farm.

Just beyond the main gate, the newly paved private lane passes the property’s original barns leading to unique, 2-acre homesites situated for optimal privacy, amazing views, and open space. Each lot offers an experience of country living – sunsets and Sonoma Mountain views; fruit tree orchards; and gently rolling hillsides changing in harmony with the seasons.

Much closer to the Bay than Healdsburg, Calistoga, or Napa, Petaluma serves up old-town country charm with all the conveniences of modern life today - shopping, schools, salons, restaurants, movie theaters, the famed concert venue Mystic Theater & Music Hall... and Wine Country.

Petaluma’s unique microclimate lends itself to the designation of its own AVA (American Viticultural Area) in 2017. Petaluma Gap is defined by 200,000 acres of vineyards tucked into Valleys and scattered on hillsides producing premium grapes that make it one of California’s best areas for growing Pinot Noir, Chardonnay, and Syrah.

The town is also recognized for its great food. New restaurants and young chefs are coming onto the scene, cultivating relationships with local small local farmers, incorporating their bounties into menus that honor the changing seasons.

For more info about Petaluma and Sonoma County, visit these websites: